The UK housing market has seen some improvements over the last couple of years but these tended to be very localized . However after the budget are we set for a new boom in new houses and a kick start to the property market?

Help To Buy

Help To Buy Scheme information advice

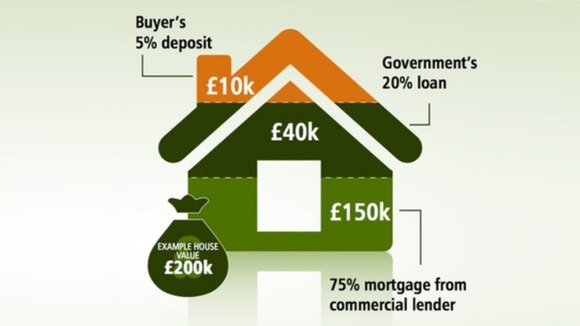

The chancellor also known by the leader of the opposition as the “downgraded Chancellor” unveiled a Help to Buy scheme, with the government putting up a fifth of the initial purchase cost of newly built houses. The Help to Buy scheme expands a previous scheme, FirstBuy, which was aimed solely at first-time buyers. It now enables ALL PURCHASERS to put down a 5% deposit on a newly built home.

“Importantly this means a much smaller deposit is now required than the banks demand”

The new help-to-buy scheme for those struggling to find mortgage deposits will include £3.5 billion for shared equity loans, and a Government interest-free loan worth 20% of the value of a new-build house. This is great news for builders and the construction industry

The new help-to-buy scheme for those struggling to find mortgage deposits will include £3.5 billion for shared equity loans, and a Government interest-free loan worth 20% of the value of a new-build house. This is great news for builders and the construction industry

Who qualifies?

The scheme is open to first-time-buyers as well as home movers

You must have a minimum deposit of 5% of the full purchase price

You must be eligible to take out a mortgage from a commercial lender

What properties are included?

New build properties only (check out the mortgage guarantee scheme below for existing properties)

Properties under £600,000 in value

Help to Buy is currently only available in England

The Chancellor said the scheme will be available to everyone who wants to buy a home from next year.

New Mortgage Guarantee Scheme

On top of this came a mortgage guarantee scheme which aimed to help people struggling to buy their own home. Osborne said £3.5bn would be committed over the next three years for new homes worth less than £600,000.

A new mortgage guarantee, sufficient to support £130 billion of loans, will help people who cannot afford a big deposit.

George Osborne said “The deposits demanded for a mortgage these days put home ownership beyond the great majority, who can’t turn to their parents for a contribution. And that’s not just a blow to the most human of aspirations, it’s a setback to social mobility and it’s been hard on the construction industry too”

The loans will be available to those who can find a 5% deposit with the loan worth up to 20% of the value of a home worth up to £600,000 and repayable when it is sold.

The price tag of £600,000 was a huge surprise that meant unlike most schemes that aimed to help first time buyers those already on the property market could receive assistance.

The Government will also offer interest-free loans for five years for those wanting to buy new-build homes.

Download

You can download full Budget report here

Useful websites

Government home ownership schemes

Author : Nick Marr

POSTED BY

POSTED BY