For many UK homeowners, their house isn’t just where they live – it’s also likely their biggest financial asset. If you’ve built up equity over the years, that value doesn’t need to sit idle. It could be the key to unlocking more affordable borrowing options when you need extra funds, whether that’s for home improvements, education costs, or consolidating debts.

In this guide, we’ll look at what home equity is, how it can help you secure better loans, and what to think about before using it as security.

What is Home Equity?

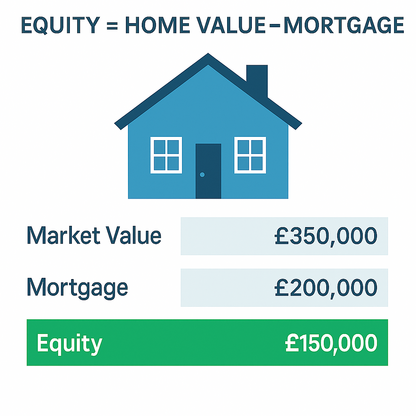

Equity is the difference between your home’s current market value and any outstanding mortgage balance. For example, if your house is worth £350,000 and you still owe £200,000 on your mortgage, you have £150,000 in equity.

As you pay down your mortgage, and if your property’s value rises, your equity grows. Lenders see this equity as an asset you can borrow against, often giving you access to more competitive deals than unsecured borrowing would.

How Can Equity Give You Better Loan Options?

When you borrow against your home equity, you’re usually looking at a secured loan, sometimes called a homeowner loan or second charge mortgage. This means the loan is secured explicitly against your property. Unlike unsecured loans, which are not backed by an asset, a secured loan gives the lender extra confidence because they have a legal charge over your home.

The main benefit is that, because your home acts as security, lenders may see you as less risky. This can translate into potentially lower interest rates than you’d get with unsecured personal loans or credit cards. Secured loans also often allow for larger borrowing amounts and longer repayment terms, making significant expenses more manageable over time.

This can be especially helpful if you’ve had issues with your credit score in the past – lenders may still consider you if there’s enough equity in your property and your overall finances look stable.

Popular Ways Homeowners Use Equity

Many people unlock the value in their home to pay for things they might otherwise struggle to fund outright. One everyday use is significant home improvements. Renovating a kitchen, converting a loft, or adding an extension can all increase your home’s value in the long run. Others use equity to cover education costs for themselves or their children, or to consolidate high-interest debts into a single, more manageable payment.

Some homeowners also use secured loans to cover major life events, like paying for a wedding or helping a family member get onto the property ladder. Whatever the goal, using equity can be a practical way to access funds without resorting to higher-cost credit.

How Much Could You Borrow?

How much you can borrow depends on several factors, including the total value of your home, the size of your existing mortgage, your income, and your credit history.

As a general guide, many lenders will allow you to borrow up to 70–85% of your home’s value when you add your current mortgage and the new loan together.

How Do You Get a Secured Loan?

The process is usually more straightforward than arranging a new mortgage but still involves several steps. Start by checking your equity – you’ll need an up-to-date valuation of your home and your latest mortgage statement.

Next, compare lenders. Not all banks and building societies offer secured loans, so it can help to work with a broker who specialises in this area and can find the best rates for your circumstances. You’ll then gather documentation, such as proof of income, recent credit reports, and information about your existing mortgage.

The lender will typically arrange their own property valuation to confirm its market value and will also need your current mortgage provider’s consent to add the new loan as a second charge. Finally, there’s some legal work to handle, like verifying ownership details and updating the Land Registry.

What to Think About Before Using Your Equity

Using your home’s equity can be an effective way to unlock better borrowing options, but it’s essential to understand the whole picture. Because your property acts as security, missed repayments could put your home at risk of repossession. Always think carefully about how you’ll repay the loan, not just now but if interest rates were to rise or your circumstances changed.

Borrowing against your equity can also affect your future plans. For instance, if you sell your home or want to remortgage later, having a second charge loan can limit what you can do or reduce how much equity is left over.

It’s vital to read the terms closely and check for any fees, such as early repayment charges, which can catch borrowers out. Make sure you understand the full cost over the lifetime of the loan, not just the monthly payment. Using an independent broker or financial adviser can help you weigh up whether this is the right option for you.

Using your home’s equity can open up more affordable borrowing options, but it’s essential to understand how secured loans work, including the risks, costs, and legal steps involved. If you’re new to this type of borrowing, reading a clear guide to secured loans can help you know what to expect.

Your property may be repossessed if you do not keep up repayments on a debt secured upon it.

Wrapping It Up

Your home is more than just a roof over your head – it can be a valuable financial tool when used wisely. Unlocking equity through a secured loan can give you access to better rates, larger sums, and longer terms than you might find elsewhere. But like any major financial decision, it pays to do your research, compare options carefully, and have a realistic plan for repaying what you borrow.

If you have questions about whether it’s right for you, seek professional advice. Used sensibly, your equity can help you take your next big step forward, without putting your home or future finances at unnecessary risk.

POSTED BY

POSTED BY