As a society, we have been slightly spoiled by technological advancement and the impact that this has had on our everyday lives. While there is an ethical argument to be had concerning automation in some circumstances, for example, it cannot be denied that concepts like this have made menial, mundane tasks far easier in the modern age.

When it comes to saving a deposit and buying a house, however, there is no doubt that we need to rely almost entirely on our own hard work and initiative. While government incentives and schemes such as the Help to Buy ISA have assisted the estimated 56% of private renters who have aspirations to buy their own home in the near future, this alone is not enough to combat stagnating earnings, rising inflation and the disproportionate cost of housing.

The combination of these factors is extremely debilitating, as it restricts the typical household’s ability to save while also driving the need for a higher deposit. To combat this, it is crucial that you strive to optimise your earnings while also minimising spending and committing as much of your disposable income as possible to your savings. Discipline will be key to this endeavour, as will your innate ability to budget precisely and make sacrifices in the quest to achieve your goal of home ownership.

How to Save a Mortgage Deposit

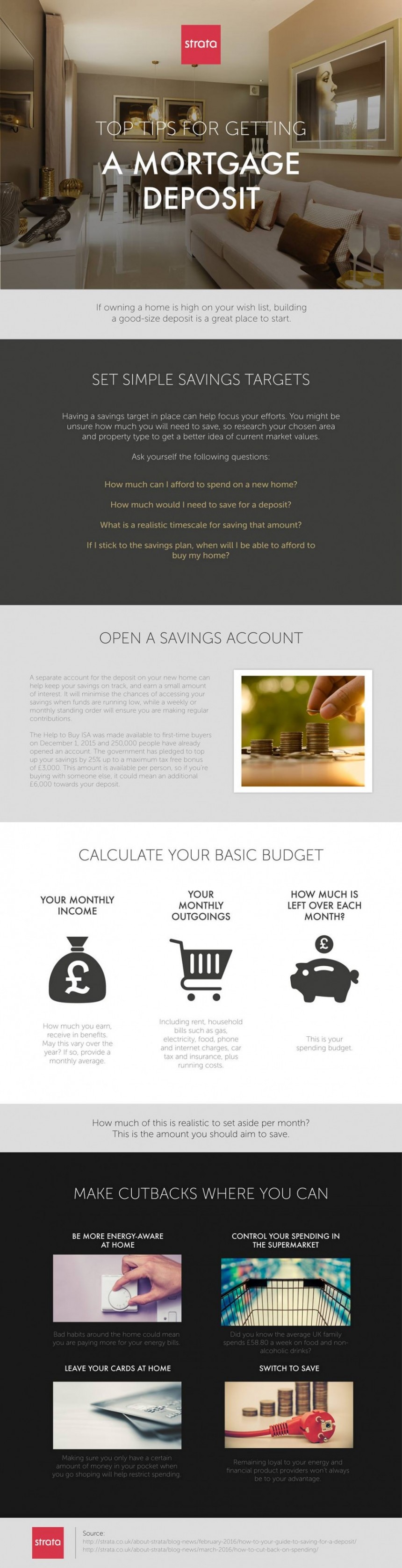

So once you have decided that you are determined to own your own home, you will need to create a financial plan of action that helps you to build a viable deposit. With this in mind, we have created the following infographic to help you on your way and provide an insight into the practical steps that are required to save in the current climate:

POSTED BY

POSTED BY