Following the delay to the implementation of HMRC’s Making Tax Digital system, TheHouseShop.com have decided to investigate how much time and money this plan will cost landlords once it is implemented.

By 2020, most businesses, self-employed people and landlords, will be expected to submit quarterly self-assessment tax returns digitally to HMRC. The aim of the new system is to make it easier for people to keep track of their tax payments, allowing them to budget accordingly, and to reduce the amounts government spends on correcting errors.

It will start with Income Tax in 2018 for businesses which will include landlords with an annual turnover above the VAT threshold of £83,000, and then subsequently it will roll out to all businesses, self-employed people and landlords with an annual turnover above £10,000 from 2019.

Our research shows that landlords will be spending up to 2-4 times more with an accountant for filing quarterly self-assessment tax returns or they will be spending up to approximately 9 hours a year to file it themselves. Landlords will be caught in the dilemma of time vs money which are both under pressure following recent government changes to Buy-To-Let investment.

TheHouseShop.com wanted to work out how much the new digital quarterly tax system will impact on landlords time, should they choose to file their self-assessment returns themselves, and what the financial impact would be for landlords who instead choose to hire an accountant.

How much do you value your time? Landlords are constantly faced with the time vs money dilemma, based on an annual rental income of £30,000, the value for 1 hour of a landlord’s time would be £16.48. According to FixedFeeAccountants.co.uk, if the landlord has maintained their financial records in a spreadsheet, it should take them no more than 3 hours per quarter with a total of 8-10 hours a year, with an extra 3-4 hours to record their other sources of income such as PAYE, interest on savings and dividends etc.

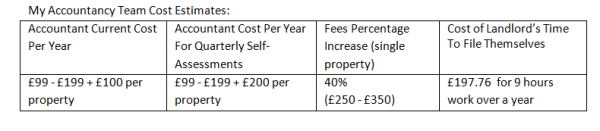

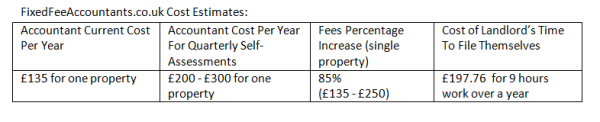

We spoke to three chartered accountancy firms to find out a rough estimate of how much landlords could expect to pay for self-assessment services when Making Tax Digital is implemented.

From this data, it is plain to see that accountants are estimating their fees to increase once Making Tax Digital comes into effect and landlords currently employing an accountant are going to be spending a lot more compared to filing their self-assessment independently.

However, in order to do this accurately and effectively, landlords will need to make the time each month to manage their tax returns which will be a barrier. Many have other demands on their time such as full-time employment and family commitments. This added pressure on landlords time will already impact those who are self-managing their properties but even more could be affected if they choose to go independent when the letting agents fees ban comes into force.

Not only would landlords need to process the payments on the free accounting software provided by HMRC each month, they will also need to keep up to date with constantly changing tax regulations and requirements.

New research from Direct Line For Business shows that landlords are already under a lot of stress and suffer anxiety over the current tax relief changes (41%); the economic uncertainty caused by Brexit (41%), inflation pressures reducing the value of their income (40%) and increased risk of prosecution and penalties surrounding Right To Rent (40%). With this in mind, having to submit quarterly self-assessment tax returns will only add to the stress that is already burdening landlords.

Nick Marr, Co-Founder of TheHouseShop.com,

“The frequency of making quarterly payments is quite excessive and could definitely be a serious barrier to some landlords, especially those private landlords who are already under a lot of pressure managing multiple properties independently.”

“It is clear to see a direct result of Making Tax Digital is an increase in the cost of accountant’s fees as well as the extra costs for the accountancy software packages, which will be yet another squeeze on landlord’s profits. Even though the government are claiming that this new tax system will help landlords know more about their tax payments, it will end up costing them a lot of money should they choose to use an accountant.”

“Although attempts and plans to make paying and recording tax simpler and more accessible to people are always appreciated, the free software package the government are saying they will be providing must be straightforward and effective for landlords to feel the benefit of the changes.”

HMRC have announced that in order to make the implementation of Making Tax Digital as painless and straightforward as possible, they will be rolling out a free accounting software programme for landlords and others to use. They claim that they will be able to download an app that can link to their bank account to upload their finances on a regular basis, minimising the stress and administration involved in processing their quarterly self-assessment tax returns.

However, according to the accountants TheHouseShop.com contacted, it’s not as easy as it sounds to use an accounting software package and landlords risk hefty fines from HMRC for even minor mistakes.

Accountants also claim that the free version will be so basic that it is effectively useless and that in reality, the vast majority of people will need to shell out for a paid option to effectively process their tax returns.

Gurpreet Sandhu, Chartered Accountant, 3 Wise Bears, commented on the potential impact of Making Tax Digital

“It’s complicated to know what will be required from landlords when Making Tax Digital comes into effect in 2020. There has been very little information provided by the government regarding the modernising of the current tax system, but what’s almost certain is the requirement for quarterly returns to be submitted during the year plus an end of year declaration which will mean a lot of administrative effort being made from accountants.”

“We expect the workload to increase by 3-4 times greater than it currently is in order to file a self-assessment tax return when Making Tax Digital comes in. This will greatly depend on the type of software solutions available and how easy it will be to use and transfer a client’s report into.”

“When Making Tax Digital comes in we expect the total costs excluding software to be 2 – 4 times more than now, I expect when we know what we have to do, we will try to make the process as efficient as possible for clients. .”

- Current costs for a one property tax return are £250 – £300 with approx £50 – £100 per extra property

- Costs could potentially rise to 2-4 times more than what they are now

- This would mean an estimated cost of £100 – £150 per quarter looking at £650 – £850 per year

Simon Thandi, a Director from FixedFeeTaxReturn.co.uk, commented on the potential increase of software costs as a knock on effect from Making Tax Digital

“Software costs £25 to £150+ per annum and even though HMRC have stated they will mandate that software suppliers will provide free, “basic” software, our discussions with most software suppliers have shown that most of them will not provide anything for free but if pushed then the free version would be as basic as to be practically useless.”

On the outset, Making Tax Digital isn’t looking too good for landlords, either they choose to spend more of their precious time on managing their self-assessment payments or, they spend more of their rental income on accountancy costs in order to save time. Not only will landlords need to spend more with an accountant once the new system is brought in, they will also need to spend money on the accounting software on top. Essentially what it boils down to is the age-old dilemma – time vs. money – and landlords are going to have to choose which road to take.

POSTED BY

POSTED BY