The UK housing market is experiencing increased activity and with it a remarkable house price jump. I ask is this a true housing market recovery or a market riddled with lack of supply and cheap finance.

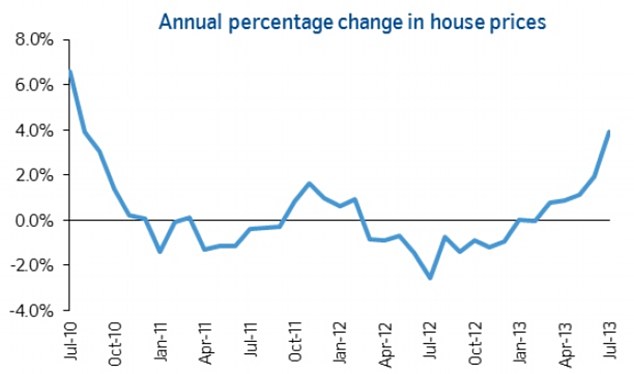

It’s a fact that houses prices rose at their fastest rate in three years last month, in further signs the market is on the mend or is it?

Prices rose by 3.9 per cent to an average of £170,825, according to building society Nationwide. Prices saw their strongest annual upswing since August 2010 and rose on a month-on-month basis by a ‘robust’ 0.8 per cent.

We all want to see activity and have been urging the mortgage industry to pull their fingers out and start lending. The good news is that the number of low deposit mortgage deals on offer has more than tripled in the year following the launch of the scheme, with 443 mortgage products available for people with a 5 or 10 per cent deposit.

I wonder how many of those approved mortgages were down in the South of the country? I have a sneaking feeling it will be a large percentage. I have seen from my international real estate website Homesgofast.com how London property is the golden boy of the overseas property market. Fuelled by rich Chinese and Russians, London tends to give the UK housing market incorrect readings.

Martin Ellis, housing economist at Halifax, said: “Sentiment regarding the outlook for house prices has improved markedly over the past three months, continuing the trend seen since late 2012. This increase in optimism is partly due to house prices being stronger than expected in the first half of the year. We continue to see a clear north-south divide with significantly higher proportions of people expecting prices to rise in the south than elsewhere in the UK.

Robert Gardner from Nationwide said “the supply side of the market remains constrained” with building activity “subdued”.

“In the first quarter housing completions in England were down 8pc compared to the same period of 2012 and around 40pc below the average number of quarterly completions in 2007,” he said.

The Help to buy scheme is allowing buyers with 5% deposit to finance a new home learn more:

I think we need to be really careful with how the government is providing cheap finance and that we don’t head for boom and bust.

A housing market on Vodka Redbull is no good for anyone.

Slow and steady is what is needed my concerns are that lack of supply combined with cheap finance will eventually price us all out of the market!

Author

Nick Marr

POSTED BY

POSTED BY